What does my Council Tax pay for?

You pay Council Tax to several different organisations. Each one charges a different amount for their services. These different amounts are added together to make your total Council Tax bill. Wyre Forest District Council is responsible for collecting the money and passing it on to these other organisations.

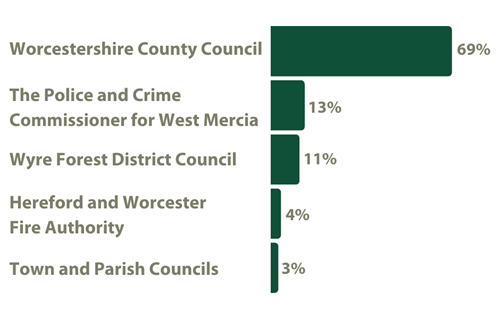

Just 11p in every pound you pay in Council Tax goes to Wyre Forest District Council.

69%

Worcestershire County Council

The majority of your total Council Tax bill goes to Worcestershire County Council. This pays for services including, but not limited to, adult social care, looked after children, road and path maintenance, libraries and waste disposal.

13%

The Police and Crime Commissioner for West Mercia

Your Council Tax helps to fight crime and keep communities safe. Read more on the financial information pages of the West Merica PCC website

11%

Wyre Forest District Council

This funds services including waste and recycling collections, planning services, business support, housing, parks and nature reserves, regeneration, elections and much more.

4%

Hereford and Worcester Fire Authority

Your money helps to support the work of this service including tackling fires, dealing with road traffic collisions and responding to major emergencies like flooding.

Read more about how Hereford and Worcester Fire Authority spend their share.

3%

Town and Parish Councils

All areas (apart from Ribbesford) have a town or parish council. The services they run vary but they can include parks/playgrounds, allotments, cemeteries, bus shelters, Christmas lights and they also comment on planning applications.

The exact amount will depend on which town or parish you live in. Read more about town and parish councils.

Detailed financial information breakdown

View detailed financial information relating to 2025/26 Council Tax.

This year the district council’s part of the bill is increasing by 3%. This means a band D property will pay £250.58 a year (less than £5 per week) for the district council’s services in 2025-26.

Most homes are band A-C so will pay less than this.

Trouble paying?

It is really important that you contact us as soon as possible if you are having difficulty paying your bill. You may be entitled to pay less Council Tax in certain circumstances.

You can ask to spread your annual bill over 12 instalments instead of 10.

You can find out more visit www.wyreforestdc.gov.uk/difficultypaying

Other cost of living support

We know many people are worried by the increased cost of living. Our Financial Inclusion team are here to help.

The team can provide information and advice on many matters including debt and budgeting, rent arrears and housing problems, council tax debt and help with claiming benefits. They will look at all areas of support that may be available to you.

Find out more at www.wyreforestdc.gov.uk/costofliving