Your Council Tax bill explained

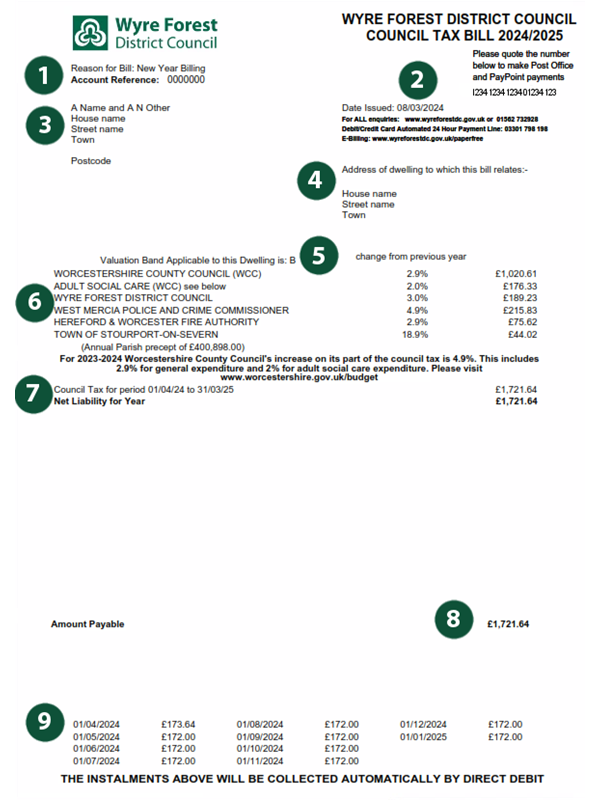

- The reason for your bill -This is the reason your bill has been sent to you. This can include the start of a new financial year , a change to your bill for example discount applied/removed, an amendment to your council tax reduction scheme, change to instalments, payment type, a new liability or end of liability due to a change of address.

Account reference - this is your reference number that is unique to your account. Please quote this reference with any payments or if you contact us about your bill. - Date issued - if you have had multiple bills, for example due to changes, please use the most recently issued one.

- The names of all liable people and the correspondence address.

- The address of the property the bill relates to. This can be the same as the correspondence address or different if named people are liable for another property.

- The valuation band of the property (A-H)

- This is a breakdown of how much of your total bill each of the authorities receive. You pay Council Tax to several different organisations. Each one charges a different amount for their services. These different amounts are added together to make your total Council Tax bill. Wyre Forest District Council is responsible for collecting the money and passing it on to these other organisations. All properties in Wyre Forest will pay the same percentage of their total to each authority, how much that equates to is listed on your bill. In Wyre Forest everyone pays to Worcestershire County Council, including Adult Social Care; Wyre Forest District Council; West Mercia Police and Crime Commissioner; Hereford and Worcester Fire Authority and their relevant parish or town council (in this example - Town of Stourport-on-Severn)

- The total Council tax charge for the billing period. Any discounts applied will be displayed here as a credit ‘CR’ and taken off your net charge, Any payments already made during this year will also be shown here as a credit ‘CR’ figure.

- This is the total amount due taking into account all discounts/exemptions/payments as shown in section 7.

- These are the instalment dates and amounts. If you have chosen to pay by Direct Debit that will be confirmed at the bottom of the instalments. If there is no Direct Debit confirmation here please contact us to set up a Direct Debit or make your payments by alternative methods.

Explanatory notes

These notes appear on the back of your Council Tax bill, or as a separate attachment to your e-bill.

Council Tax is payable on most dwellings whether owned or rented. Each dwelling has been allocated to one of eight valuation bands (shown on the bill) according to its open market value at 1 April 1991:

Band A up to £40,000

Band B £40,001-£52,000

Band C £52,001-£68,000

Band D £68,001-£88,000

Band E £88,001-£120,000

Band F £120,001-£160,000

Band G £160,001-£320,000

Band H over £320,000

The following is a summary and is for guidance only:

Single Person Discount - the bill assumes there are two adults (aged 18 or over) living in the property. If only one adult lives in the property, they must apply for a single person discount for the bill to be reduced by 25%.

Class C – if your property is unoccupied and unfurnished you may be entitled to a 100% discount for 1 month.

Note for Landlords: Class C discount applies from the date the property becomes unoccupied and substantially unfurnished which can often be before the tenancy end date. Therefore your tenant may be entitled to part, or all of this ,1 month discount period.

Class D – if your property is unoccupied and unfurnished, which needs, is undergoing or has undergone major repair works to make it habitable or is undergoing or has undergone structural alterations you may be entitled to a 50% discount for up to a maximum of 12 months.

Annexes - A 50% discount may apply where an annexe is occupied by a relative of the Council Taxpayer for the main property or where it is used as part of the main property.

Certain people will not be counted when looking at the number of adults living in a property if they meet certain conditions:-

- Full-time students, student nurses, apprentices & youth trainees.

- Patients resident in a hospital, care home or nursing home.

- People who are severely mentally impaired.

- Residents of certain hostels or night shelters.

- Careworkers on low income.

- 18 & 19 year olds who are at, or have just left, school.

- Members of religious communities (e.g. monks & nuns).

- People caring for someone in need of constant care who is not their spouse, partner or child under 18 years old.

- People in prison (except for non-payment of Council Tax or a fine).

- Members of visiting forces & certain international

If all residents are disregarded as above the Council Tax bill is reduced by 50%. If a property is no-one’s main home, and it is not exempt, the Council Tax bill may be reduced.

Disabled person reduction

If a disabled person - adult or child - needs an extra room (not WC) or extra space in the property to meet needs arising from the disability, the bill may be reduced to that of a property in the next band down. This applies to dwellings in bands B to H. Dwellings in band A will be a figure equivalent to five ninths of a band D property.

Council tax reduction scheme

If you are on a low income you may be entitled to some financial help.

Application forms and information are available from www.wyreforestdc.gov.uk/ctrs

You can appeal to the Listing Officer against the valuation band if your property has physically changed since 1 April 1991 or it is less than 6 months since

- you became the Council Taxpayer for the property or

- the last band change.

How to appeal can be found at www.gov.uk/challenge-council-tax-band or by e-mail gov.uk/contact-voa.

If you wish to appeal, for any of the following reasons, you must firstly notify the Council in writing - If you think you are not the liable person, think the dwelling should be exempt, you disagree with the amount of Council Tax Reduction Scheme or that the Council has failed to consider all relevant information in calculating the bill.

If your appeal has not been resolved within 2 months you may appeal to an independent Valuation Tribunal.

Appealing does not allow you to withhold payment of Council Tax in the meantime. If your appeal is successful, you will be entitled to a refund of any overpaid Council Tax.

Some properties may be exempt from Council Tax. The following is a summary and for guidance only.

Empty properties

B Unoccupied and owned by a charity. Exempt for up to 6 months from the date property was last occupied by or on behalf of the charity.

D Empty property due to person being in prison.

E Empty property due to person having gone to live in a hospital or care home.

F Council Taxpayer deceased (leaving property unoccupied). Exempt for up to 6 months from grant of probate or letters of administration.

G Occupation prohibited by law.

H Unoccupied property being held for a minister of religion.

I Empty property due to a person living elsewhere to receive personal care other than in hospital or care home (see Class E).

J Empty property due to person living elsewhere to provide personal care.

K Empty property owned and last occupied by a full time student.

L Empty property where a mortgage lender is in possession of property.

Q Unoccupied property under the administration of a trustee in bankruptcy.

R Unoccupied caravan pitch or boat mooring.

T Unoccupied separately banded property forming part of another property or situated within the curtilage of another property, which cannot be let separately.

Occupied properties

M Property comprising a hall of residence provided predominantly for the accommodation of students.

N Property occupied only by students.

O UK Armed Forces accommodation owned by the Secretary of State for Defence.

P Visiting armed forces accommodation.

S Property occupied only by persons under 18 years of age.

U Property occupied only by severely mentally impaired person/s. This does not apply to residential homes.

V Main residence of a person with diplomatic privilege or immunity.

W An annexe or similar self-contained property occupied by elderly or disabled relative of the resident/s living in the rest of the property.

Note: the property may need to meet some conditions before it can be exempt from council tax.

If you think you might be entitled to a discount, disregard or exemption please contact the Council.

Long term empty properties are charged at 100%.

From 1 April 2024 properties that have been empty for 1 year will be charged at 200%.

Properties empty between 5 and 10 years are charged 300%.

Properties that have been empty for 10 years or more are charged 400%.

The Statutory Instalment Scheme is 10 monthly instalments however you now have the option to request 12 monthly instalments.

If your bill shows that a discount or exemption has been allowed, you must tell the Council within 21 days of any change of circumstances which may affect your entitlement. Failure to do so may result in £70 penalty.

Wyre Forest District Council is under a duty to protect public funds. It may share information with other bodies responsible for auditing or administering public funds to prevent and detect fraud.

For adult social care authorities, council tax bills show two percentage changes: one for the part of the overall change attributable to the adult social care precept and one for the part attributable to general expenditure.

Trouble paying?

It is really important that you contact us as soon as possible if you are having difficulty paying your bill. You may be entitled to pay less Council Tax in certain circumstances.

You can ask to spread your annual bill over 12 instalments instead of 10.

Find out what happens if you miss a payment and how we can help if you're struggling